By Ernesto Castañeda

Interview by Diana Castrillon with Ernesto Castañeda published in Stornia August 13, 2024. Edited and expanded by Castañeda. Original in Spanish. Translated by Castañeda.

Diana Castrillon: “Irregular immigration is one of the most important issues in the presidential campaigns of the candidates, Republican Donald Trump and Democrat Kamala Harris. On the one hand, the Biden administration, of which Vice President Harris is part, restricted the number of asylum seekers entering the country, and on the other hand, Republicans are promising the “largest mass deportation program in US history” if they win the White House this fall.

Anti-immigrant sentiment in the United States is on the rise, with more than half (55%) of Americans this year saying they would like to see a decrease in immigration, a first since 2001. This is partly due to the belief that immigrants, particularly undocumented immigrants, are a burden on government resources and contribute nothing to the economy.

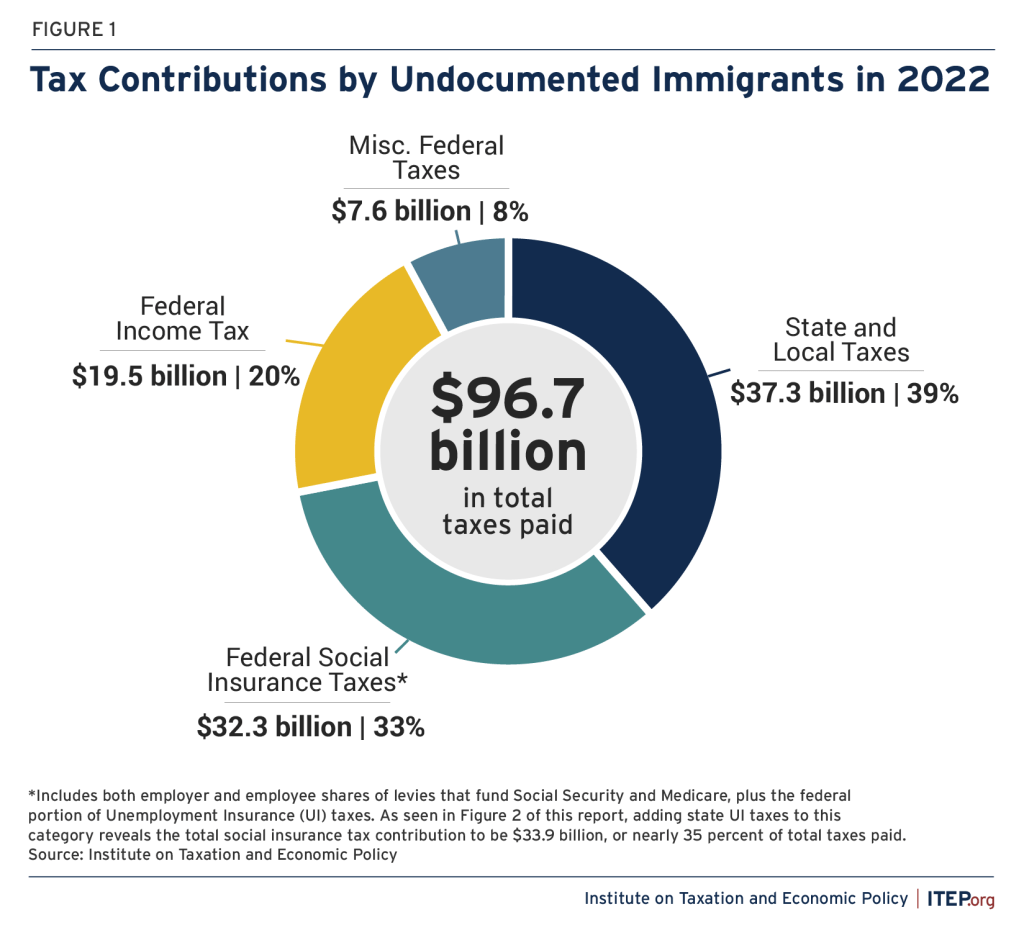

However, a new study from the Institute on Taxation and Economic Policy shows that the opposite is true. According to the report, undocumented immigrants contributed nearly $100 billion in taxes during 2022, while being unable to access many of the programs their tax dollars funded. Of that nearly $100 billion, $60 billion went to the federal government. For every million undocumented immigrants, federal services receive an additional $8.9 billion in tax revenue. More than a third of the taxes paid by these immigrants go to programs they cannot access, such as Social Security ($25.7 billion), Medicare ($6.4 billion), and unemployment insurance ($1.8 billion).

In addition, undocumented immigrants often pay higher tax rates than American citizens: in 40 of the 50 U.S. states, illegal immigrants pay higher state and local tax rates than the 1% of households with the highest incomes. In addition, they cannot receive many tax credits and often do not realize that they can claim refunds or prefer not to. “In total, the federal tax contribution of undocumented immigrants amounted to $59.4 billion in 2022, while the state and local tax contribution stood at $37.3 billion,” the authors of the study wrote. “These figures make it clear that decisions on immigration policy have substantial implications for public revenues at all levels of government,” the report says.

In an interview with Stornia, Ernesto Castañeda PhD, Director of the Immigration Lab and the Center for Latin American and Latino Studies at American University in Washington DC, said that immigrants are necessary and essential for the economic growth of the United States.

Diana Castrillon: How does an undocumented immigrant pay taxes, if as their name suggests, they are irregular migrants?

Ernesto Castañeda: Undocumented immigrants pay taxes every time they buy something; there is a sales tax, and the percentage depends on each locality. If they buy houses, they also pay taxes, or if they rent, there is a percentage that must be paid in taxes to the local and federal governments. Undocumented people who work in formal companies, which are many, can have a temporary identification to pay taxes (ITIN), which works in a similar way to a Social Security number, so they pay payroll taxes like any other person working in the United States. There are some undocumented people who use false or incorrect identification documents, but someone lends them one, and so they pay into the Social Security and retirement and health programs. However, since the number is false or does not belong to them, they do not have access to those benefits when they retire. So, not only do they pay for these services, but many immigrants do not ask for these benefits. Therefore, they have a net or even greater contribution than the citizens who pay, but then they withdraw those benefits such as social security after retirement. It is a gain that the federal government and the Treasury openly accept that happens.

So, are undocumented immigrants paying more taxes than American citizens themselves?

Yes—the rate of many undocumented people who pay taxes is higher than the rates paid by the richest people in the country. Of course, their incomes are different, but the rate is sometimes higher or very similar to that of citizens. Citizens fill out their tax returns and often ask for tax returns and reimbursements, for example, they get a credit for having children, but many undocumented taxpayers do not make these claims because they do not want to be denied citizenship in the future for having asked for aid. Nor do they ask for support programs for their children, who are already citizens and have the right to those services, out of fear. We have documented that, indeed, immigrants use fewer social services than U.S.-born citizens (Castañeda and Cione, 2024).

It seems that undocumented immigrants are between a rock and a hard place now with the electoral campaign on both the Republican and Democratic sides. Is there concern in the community?

Some politicians use undocumented immigrants as scapegoats. On the one hand, Trump makes this threat of mass deportations, but it is unlikely that he will do it. He had promised that before, and when he was president, he did not deport as many people. That doesn’t mean that people aren’t scared now, and if he wins, he’s going to create real terror among the people who already live in fear of themselves or their family members being found. That’s a reality that undocumented immigrants have been living with for many years.

As for asylum, in fact, many people are fleeing Cuba, Venezuela, Nicaragua, and Haiti, many with proof of persecution, and now the government has changed how it processes these asylum cases. The border is closed to many of these asylum requests as it was during the pandemic, so we’re seeing fewer people let in through the wall in between ports of entry. The Biden-Harris administration thinks that this can help them electorally so that Republicans don’t criticize them about the border supposedly being open or about undocumented individuals or those seeking asylum temporarily receiving food and housing in some cities. At some point, they will have to reopen the border to asylum seekers because national and international law calls to receive people who are asking for asylum. Some will be accepted, others will not after processing their applications.

Trump would need a lot of money and policing. He would have to create a totalitarian state to be able to deport all the people who are here. Many of these people have been here for more than 10 years. Their children are citizens. They work, and they contribute. So, deporting in massive numbers or stopping receiving immigrants and asylum seekers is a great attack on the United States and the economy could contract. Massive deportations from the interior could create a recession because, as we indicated, migrants pay billions in taxes. However, taxes are a small percentage of what people earn, and most of what immigrants earn is spent in the cities where they live. With the work they do, they generate economic growth, services, and entertainment.

A few days ago, JD Vance, Donald Trump’s vice-presidential candidate, justified the mass deportation plan and said that undocumented immigrants are stealing jobs from American citizens. Is there a line of Americans waiting for immigrants to be deported to take their jobs?

It doesn’t work like that. Trump and Vance are wrong about immigrants taking jobs from citizens or African Americans. It’s an easy stereotype to sell. Some voters may have had an experience where it seemed that could be the case. However, if we look at the economy in general, immigration generates new jobs. In Florida, the strictest anti-immigrant law in the country is in effect. In fact, many undocumented immigrants have left the state, and today, there is not enough labor for construction, services such as hotels, or even to pick oranges. So, the businesses that needed that labor to generate wealth now do not have their business functioning 100%. Middle-sized farm owners have had to close because they lack the labor, and some small businesses have had to limit their service hours. If there is no construction, there is no housing, and there is more inflation for existing housing. Immigrants arrive and need a place to live, someone to cut their hair, and someone to sell them food, so they generate work and income for merchants. Immigrants start more service businesses, as well as large companies, than those born in the United States. We also know that in general, immigrants employ more people than business owners who are from the country.

It is not like there is an economic pie that is shared by the number of people who are here plus those who arrive. Indeed, the more people arrive, the bigger the pie becomes, so there will be more pie for everyone to share. It is not unfair competition, and that is seen in the unemployment rates. Under the Biden-Harris administration, we have a historically low unemployment rate for African Americans and for Latinos. There are very few citizens of European origin who are unemployed because some immigrants are taking their jobs. They usually do not find work because they do not have enough education to take a job or, on the contrary, because they have too much education and there is no high-income job that they can take. Or because they refuse to move to look for work. Unemployment rates are low and what business owners complain about is that they do not have enough staff in organizations to expand their businesses. This also affects citizens looking for services and having to wait longer in restaurants because there are not enough waiters or cooks.

What is the answer to immigration management, more temporary employment visas, legalizing undocumented immigrants, or building more walls on the border?

The solution to long-term cases of irregular immigration is to increase temporary employment visas so that people can migrate legally. There are programs such as the H2A and H2B visas, which are examples of visas that work very well. People come, work, and return to their country because they have already earned income in dollars and want to be with their families. The problem is that there are limits, there are quotas for these visas, they are for certain types of jobs, and there is more demand for these temporary workers than the law allows. Congress has to pass legislation to increase the number of these visas. Thus, the House of Representatives and the Senate, along with enough members from both parties, have to agree. Many Republicans refuse to reform immigration because they want to use it for electoral purposes rather than solve the issue.

For the people who are already here, the solution is to legalize them. By giving papers or work permits to those who are here, many would earn more money, have more confidence to invest, and pay more taxes. This would be an injection into the American economy, and they could bring their relatives legally and expand the worker base a little more. That is something that neither Trump nor Vance understands, and they would never do it. Unlike President Ronald Reagan, who did sign a law like that, although reluctantly. It is not something that Kamala Harris or Tim Walz have wanted to talk about much in the campaign either because people use it as a very simple attack, but they have a political history of supporting these types of measures.

And with this legalization of undocumented immigrants in the United States, do Latin American countries win or lose?

Remittances represent only 4% of the wealth that immigrants generate in the United States, and a migrant who is more established sends remittances less often. Remittances help support families in economic need, but they represent long family separations until the migrant ends up returning or tries to bring the entire family. So, it is short-term help, but it puts families that are divided in emotional difficulty. In any country that loses migrants, from farmers to scientists, from teachers to doctors —like Cuba which loses a couple of million professional migrants every year for the last couple of years— and increasingly weakens its economy. The same is true of the Venezuelan economy, which, among other things, has been weakened by emigration.

Remittances are short-term aid, but the real economic growth happens where the migrants live, in this case, the United States.

According to the study by the Institute for Fiscal and Economic Policy, work authorization would be beneficial for everyone since granting undocumented immigrants a work authorization would result in an increase in their tax contributions from $40 billion to $137 billion per year since the work authorization would increase salaries.

Ernesto Castañeda PhD, Director of the Immigration Lab and the Center for Latin American and Latino Studies, American University in Washington DC.

This piece can be reproduced completely or partially with proper attribution to its author.

The Spanish version of this text is available at the following link: https://aulablog.net/2024/08/26/deportaciones-masivas-podrian-crear-una-recesion-en-ee-uu/