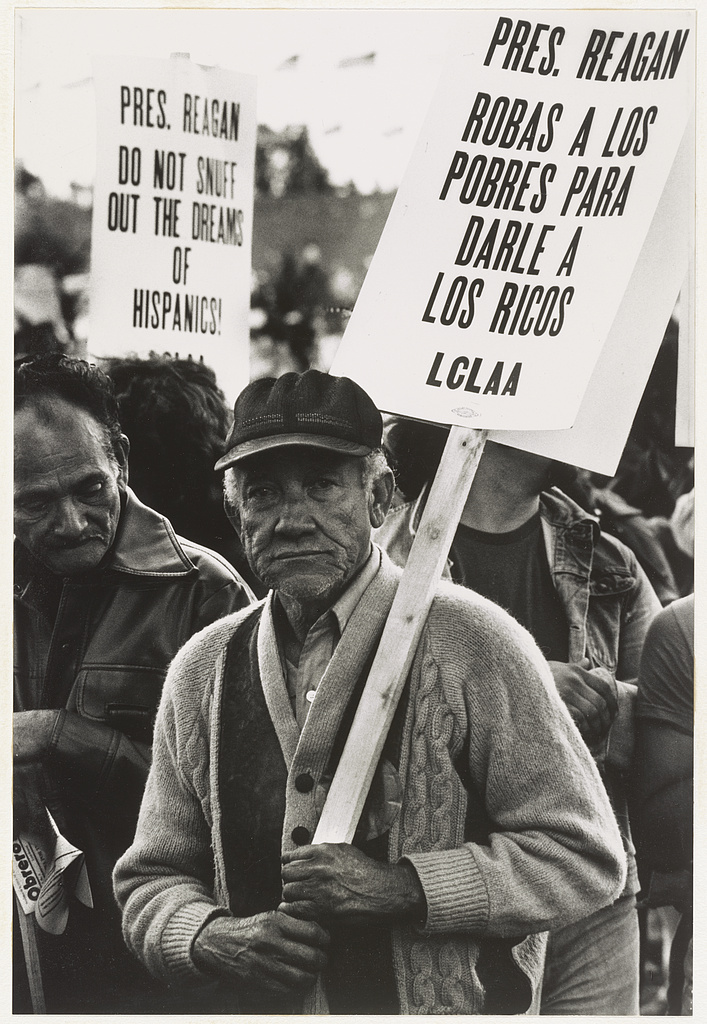

(Source: Wikimedia Commons)

By Isabella Serra & S. Shrestha

On January 24, 2006, Estuardo Remache was criminally charged with domestic violence and removed from his position as head of Ecuador’s Human Rights Commission. The case was brought forward by his wife, Maria Lucrecia Nono, who had spent years seeking justice for the repeated abuse she endured. On numerous occasions Maria’s attempts to report the violence were dismissed, her credibility questioned, and her intentions painted as vindictive.

When Maria first turned to local authorities and Comisarías, state-run women’s centers meant to support survivors of gender-based violence (GBV), she was told her case was a personal matter to be resolved at home. Officials cited Article 191 of the Ecuadorian Constitution, which separates the federal and Indigenous legal systems, and told her she must seek justice within her own Kichwa community.

Gender-based violence, which includes emotional, physical, and sexual harm rooted in gender inequality, is a widespread and deeply structural form of oppression. Maria’s abuse didn’t stop at home; it was reinforced by the very institutions intended to protect her. Each time she sought help, she was met with indifference, disbelief, or outright rejection, despite returning with visible bruises and ongoing emotional trauma. Her story points to a more systemic issue: the absence of female political power in Ecuador to challenge and transform these injustices.

Maria’s ordeal highlights a troubling paradox: the greater presence of women – particularly Indigenous Kichwa women – in Ecuador’s political sphere, alongside the continued high rates of GBV in their communities. Why, despite growing political representation for women, does gender-based violence remain so entrenched, especially among Indigenous communities?

Legal and Structural Context

Ecuador’s 2008 Constitution marked a turning point, officially recognizing the country as plurinational and intercultural, thus legitimizing Indigenous governance structures alongside the national legal system. Yet this dual system has limitations. While intended to acknowledge indigenous sovereignty, in practice it often creates conditions of legal marginality, particularly for Indigenous women. In Maria’s case, the national judiciary abdicated responsibility, claiming the Kichwa system to be the appropriate jurisdiction, while Kichwa authorities sought to silence her to avoid casting their communities in a negative light.

This tension reflects a broader legal failure: the promotion of state-sponsored multiculturalism but the failure to protect vulnerable populations within specific communities. The burden of representation falls heavily on Indigenous women like Mirian Masaquiza Jerez, a Kichwa woman staffing the UN Permanent Forum on Indigenous Issues. In an interview, she explained that any missteps are seen not as individual failings, but as reflections on her entire community. Despite these pressures, her greater visibility, along with that of many others, marks a notable shift in the gendered landscape of Ecuadorian politics

Gender-Based Violence in Context

Ecuador has made substantial progress toward increasing women’s political representation, thanks in part to gender quotas implemented since the early 2000s. These measures mandate a minimum number of female candidates in national and local elections, enabling more women to ascend to political leadership. Despite recent infighting and a diminished presence in the national legislature, Ecuador’s Indigenous-led Pachakutik party has played a pivotal role in this shift over the past three decades, advocating for environmental justice and Indigenous rights, including those of women.

Yet political representation does not always translate to structural change. The existence of women in positions of power can obscure the continued suffering of those on the margins. Indigenous women in rural areas still live under deeply patriarchal norms, face high rates of GBV, and often lack access to justice, health care, or safe housing. Nearly 6 in 10 women in Ecuador report having experienced GBV. The rate rises to 68 percent among Indigenous women, 10 percentage points higher than among their non-indigenous counterparts. These figures expose the intersectional nature of GBV: it disproportionately affects women who are poor, Indigenous, or otherwise marginalized. GBV is not just a personal issue; it is a societal failure sustained by socioeconomic inequality, cultural norms, and weak legal protections.

In many Indigenous communities, patriarchal expectations remain strong. Divorce and contraceptives are taboo, and women who speak out like Maria risk being ostracized by their families and communities. Maria’s relatives warned her that if she pursued legal action, she might lose custody of her children. And she nearly did: Estuardo Remache was awarded custody of four of their five children before he was convicted.

Eco-Politics, Exploitation, and Gendered Harm

The entanglement of environmental exploitation and gender inequality has further exacerbated the issue. Since the 1960s, Ecuador’s adoption of a free-market model encouraged the expansion of oil extraction in the Amazon. While economically beneficial in the short term, these projects have devastated Indigenous lands and polluted vital resources. The resulting health effects, such as increased miscarriages and birth defects, are disproportionately born by women.

Historically oil companies, empowered by deregulation, offered large financial incentives to communities in exchange for land. Communities that resisted remained poor and resource scarce. Those who accommodated faced social stigma, displacement, and environmental degradation. Both paths potentially deepened indigenous poverty.

These developments have reshaped gender roles. As men leave to work for the very oil companies that displaced their communities, women are left to manage households, often under increased financial and social stress. This dynamic has continued to entrench patriarchal authority and contributes to higher rates of domestic violence. Workers exposed to exploitative labor, drugs, and alcohol often bring that trauma home. Women, already made vulnerable by poverty and legal liminality, often suffer the consequences.

While the 2008 Constitution granted new rights, Ecuador’s laws have failed to notably improve conditions for indigenous women, and in some cases, have exacerbated hardships. The continued expansion of extractive industries under new hydrocarbons and related environmental laws, has led to further environmental contamination, social disruption, and increased gendered violence.

Reassessing “Progress”

After years of litigation, Ecuador’s Constitutional Court issued a judgment in 2014 finding that María Lucrecia Nono’s constitutional rights had been violated. Yet the ruling did not bring closure: the prolonged process left her struggle for justice fundamentally unresolved.

Maria’s story is often held up as an example of progress, offered as proof that Indigenous women can now access justice. But this interpretation is dangerously reductive. Maria’s case dragged on for years. She endured physical and emotional abuse, not only from her husband but from a system that refused to believe her. Even after winning she paid a steep price: continued violence, loss of custody, and pressure from Indigenous political leaders urging her to remain silent to protect their image.

Her case exposes the limits of symbolic victory. Representation alone is not enough to dismantle cultures of impunity and deeply rooted systems of oppression. Real justice requires the transformation of legal systems, political norms, and economic structures that continue to marginalize Indigenous women.

Conclusions

Ecuador presents a complex landscape: a country lauded for increasing female political representation, yet plagued by high levels of GBV, especially within Indigenous communities. Maria Lucrecia Nono’s case is not a victory; it is a warning. It illustrates how cultural recognition, extractive capitalism, and patriarchal power can conspire to silence women, even when they appear to be gaining political stature.

The emergence of Indigenous women in Ecuador’s political sphere is long overdue. But without corresponding reforms in legal protections, community norms, and economic structures, political power will remain largely symbolic. True liberation for Indigenous women in Ecuador will require dismantling the intersecting systems that perpetuate gender-based violence, which requires listening to women like Maria not only when they win, but when they are silenced.

Isabella Serra & S. Shrestha are Research Assistants at The Immigration Lab